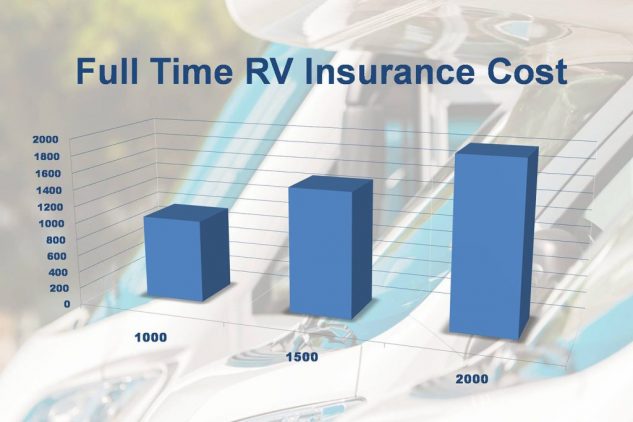

How Much Does Full-Time RV Insurance Cost Per Year?

On average, full time RV insurance cost $1500. RV insurance costs range from $1000 to $2000 for most RVs in the US in 2019. However, RV insurance policies and the costs can vary. While a Class C RV insurance policy may only cost $1000, a Class A RV could be upwards of $2000. How big the RV is, will have an influence on its insurance costs too. American insurance agencies use 3 class sizes to rate RVs. Class A RVs are full-size luxury motor homes that furnish full-time living amenities for their owners. Sometimes known as “camper vans,” Class B RVs are smaller and less lavish but may still be inhabited on a full-time basis. Class C RVs are even smaller and less comfy.

Full Time RV Insurance Cost Factors

The cost of full-time RV insurance depends upon a number of factors. First, the resale value of the RV accounts for a significant amount of the RVs insurance costs. A new, more expensive RV will typically cost more to insure than a used RV.

RV Theft Coverage

The likely hood of theft, break-ins and criminal damage plays a part in RV insurance cost estimates as well. While RVs usually aren’t as likely to be stolen as your average automobile, they can be an excellent target for burglars and delinquents. This is particularly true when the RV is left unattended at a RV park or campsite. Where the RV is stored play a major factor in how vulnerable your RV is. An RV that spends the most of its time in areas with high rates of property crime will cost more to insure than a vehicle stored in a quieter area. RV insurance agencies usually use ZIP code information to determine the RVs risk of damage.

RV Road Accident Coverage

The risk of an accident can drastically affects the cost of RV insurance. Because most RV driving happens on high-speed highways and rural roads, RVs that are driven frequently run the risk of being in a serious accident. Also, repair costs for a RV are a lot more than the costs of repair work performed on a typical automobile. Because RV’s high resale value and the possible scarcity of replacement parts.

What Won’t Be Covered By Full-Time RV Insurance

A good deal RV insurance policies won’t cover interior furnishings or personal belongings. While some insurance agencies offer policy riders for those wanting to protect the valuables stored in their RVs, it’s usually more practical to take out a separate policy on each valuable item. A lot of RV owners also like to store their valuables outside of their RV in lock boxes or secure storage units.[/vc_column_text][/vc_column][/vc_row]